Unlocking Financial Stability: The Ultimate Guide to Option Strategy Hedging Risk Management

In a volatile financial market, safeguarding your investments is paramount. Option strategy hedging is a powerful tool that empowers you to mitigate risks and enhance your portfolio's resilience. This comprehensive guide will equip you with a deep understanding of option hedging strategies, enabling you to navigate market fluctuations with confidence and maximize your investment potential.

Understanding Option Hedging

Option hedging involves using options contracts to offset the potential losses incurred from underlying assets. By creating a synthetic position, you can effectively reduce the volatility and cushion the impact of adverse price movements. Options offer a wide range of flexibility, allowing you to customize the hedging strategy to suit your risk tolerance and investment goals.

4.3 out of 5

| Language | : | English |

| File size | : | 11201 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 130 pages |

| Lending | : | Enabled |

Types of Option Hedging Strategies

Various option hedging strategies exist, each with unique characteristics and applications. Here are some of the most commonly used strategies:

- Delta Neutral Hedging: Aims to create a portfolio with a neutral delta position, making it insensitive to small price fluctuations.

- Hedge Ratio Hedging: Uses a specific ratio of options contracts to underlying assets to achieve a desired level of protection.

- Collar Strategy: Combines a protective put option with a call option to limit both potential gains and losses.

li>Married Put Strategy: Pairs a long stock position with a protective put option, offering downside protection while maintaining upside potential.

Benefits of Option Strategy Hedging

Option strategy hedging offers numerous advantages for investors:

- Risk Mitigation: Reduces the potential losses from adverse market movements, providing a safety net for your investments.

- Portfolio Diversification: Introduces a new asset class to your portfolio, enhancing its overall diversification and risk-adjusted return.

- Income Generation: Selling options premiums can generate additional income while hedging against risk.

- Customization: Allows you to tailor the hedging strategy to your specific risk tolerance and investment objectives.

Implementing Option Hedging Strategies

Mastering option strategy hedging requires a systematic approach:

- Identify the Underlying Asset: Determine the asset or portfolio you wish to hedge.

- Assess Risk Tolerance: Determine the level of risk you are willing to accept and select an appropriate hedging strategy.

- Choose Option Type: Opt for call or put options based on your hedging objective (e.g., protecting against downside or limiting upside).

- Calculate Hedge Ratio: Determine the optimal ratio of options contracts to underlying assets to achieve your desired level of protection.

- Monitor and Adjust: Regularly monitor market conditions and adjust your hedging strategy as needed.

Option strategy hedging is an indispensable tool for risk-averse investors seeking to safeguard their investments in volatile markets. By understanding the various hedging strategies, their benefits, and how to implement them effectively, you can enhance your portfolio's resilience, mitigate potential losses, and maximize your chances of investment success.

Additional Resources

- The Options Playbook: The Ultimate Guide to Leveraging Options for Strategic Investing

- Option Trading for Dummies: A Detailed Guide to Hedging Your Investments

- Schwab Center for Financial Research: Option Hedging Strategies

4.3 out of 5

| Language | : | English |

| File size | : | 11201 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 130 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Catherine Friend

Catherine Friend Brian Mcgilloway

Brian Mcgilloway Bryan Goodwin

Bryan Goodwin Brett Allen

Brett Allen Carlos Torres

Carlos Torres Catherine Christensen

Catherine Christensen Carla Schroder

Carla Schroder Brian Jenkins

Brian Jenkins Caitlin Mullen

Caitlin Mullen Burst Books

Burst Books Cassandra Khaw

Cassandra Khaw Buck O Neil

Buck O Neil Carmen Moreno

Carmen Moreno Brian Dougherty

Brian Dougherty Carol Dawson

Carol Dawson Brian Kateman

Brian Kateman Caroline Arnold

Caroline Arnold Carolyn Brown

Carolyn Brown C J Brown

C J Brown Brittany Noelle

Brittany Noelle

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Miguel NelsonFollow ·19.6k

Miguel NelsonFollow ·19.6k Milton BellFollow ·2.4k

Milton BellFollow ·2.4k Jordan BlairFollow ·15.6k

Jordan BlairFollow ·15.6k Virginia WoolfFollow ·10.3k

Virginia WoolfFollow ·10.3k Craig BlairFollow ·7.4k

Craig BlairFollow ·7.4k Maurice ParkerFollow ·5.6k

Maurice ParkerFollow ·5.6k Chinua AchebeFollow ·6.7k

Chinua AchebeFollow ·6.7k Stuart BlairFollow ·9.6k

Stuart BlairFollow ·9.6k

Andy Hayes

Andy HayesUnveil the Rich Tapestry of Rural Life: Immerse Yourself...

Step into the enchanting pages of "Still...

David Mitchell

David MitchellUnlocking the Depths of Cybersecurity: An In-Depth Look...

In the ever-evolving landscape of...

Seth Hayes

Seth HayesUnlock the Secrets of Watercolor Landscapes: 37 Tools for...

Embark on a...

Tyler Nelson

Tyler Nelson15 Insightful Answers to Questions on Uterine Fibroid

Uterine fibroids...

Evan Hayes

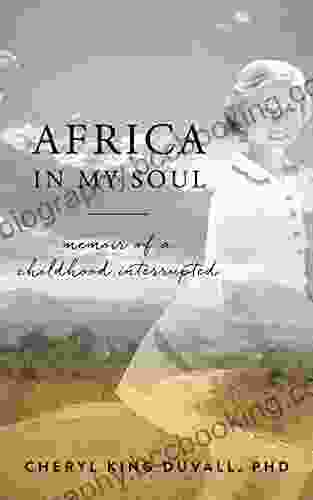

Evan HayesAfrica In My Soul: A Literary Odyssey That Captivates the...

In a world where diverse cultures...

4.3 out of 5

| Language | : | English |

| File size | : | 11201 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 130 pages |

| Lending | : | Enabled |